The Nationwide

Advantage

The Nationwide

Advantage

The Value of an Attorney

When you’re forming a new entity – whether it’s an S-Corp, C-Corp, or LLC – nothing’s more important than the peace of mind that comes from knowing you have an expert in your corner. Take advantage of Nationwide Incorporators’ free initial consultation to explore your entity options and answer all of your questions. Our personal service sets Nationwide Incorporators apart from the competition. We’ve helped thousands of entrepreneurs just like you!

Fast and Simple

Provide Nationwide Incorporators with a few key details of your business and our experts will take care of the rest. We’ll review your order and make sure everything looks correct. If we notice anything unusual, we’ll contact you be before we get started. Then we’ll make sure the name you’ve chosen is available in the state of your choosing, and prepare and submit your Articles of Incorporation or Organization for filing with the Secretary of State. When the Articles are approved, legally establishing your entity, we’ll customize your final forms and documents and file your EIN application and any other applicable forms with the IRS.

Competitive and Affordable Pricing

Our digital corporate and LLC packages provide you everything you need to legally form your entity and register with the IRS so that you can open your company’s bank account and get started. While some clients may need additional services with additional fees, there are no hidden or added fees for our basic packages. All of our packages also include the first year of legally required Registered Agent services. Most importantly you know you have a resource ready to answer any questions that may arise throughout the formation process and even after your order is complet

8,000

Happy Clients

30+

Years In Business

FREE

Initial Consult

8,000

Happy Clients

30+

Years In Business

FREE

Initial Consult

What Our Clients Are Saying

What Our Clients Are Saying

Ethical Personnel Services, Inc. dba A Professional Personnel Service

Frequently Asked Questions

How do I know if I need to create an entity?

There are no hard and fast rules, but if you don’t expect the business to generate at least $50,000 in revenues in the first year, creating an entity is probably not worth the expense and maintenance obligations.

I’m buying a house as an investment. Do I need an LLC?

An LLC is not typically required for investment real estate. If you’re buying a one-to four-unit residence as an investment and intend to use a conventional 30-year mortgage to finance it, title to the property cannot be held in an LLC. Also, for most people, such a property will not generate enough revenue to justify the cost to set up and maintain an LLC and there are other ways to protect against potential liability. While there may be reasons to recommend an LLC in these circumstances, it is usually not necessary. We frequently advise clients that forming an entity may not be necessary or is premature. Call us at 800-525-4780. We’re happy to help evaluate your unique circumstances.

How long does the entity formation process take?

Once you have determined the type of entity you would like to create and identified a name, our team will get started on the filing right away.While the incorporation process can vary from state to state, it generally takes about 10 days to two weeks, depending on the speed with which the respective Secretary of State processes the documents.

Can I get it faster than standard time?

Some states allow the process to be expedited for an additional fee.

You’ve set up my entity and provided my documents. What if I have a question?

Our services don’t end with the delivery of your corporate documents.Many clients have questions in the initial months of operation. We’re here to take your call and answer your questions so that you can be successful with your new entity.

Frequently Asked Questions

How do I know if I need to create an entity?

There are no hard and fast rules, but if you don’t expect the business to generate at least $50,000 in revenues in the first year, creating an entity is probably not worth the expense and maintenance obligations.

I’m buying a house as an investment. Do I need an LLC?

An LLC is not typically required for investment real estate. If you’re buying a one-to four-unit residence as an investment and intend to use a conventional 30-year mortgage to finance it, title to the property cannot be held in an LLC. Also, for most people, such a property will not generate enough revenue to justify the cost to set up and maintain an LLC and there are other ways to protect against potential liability. While there may be reasons to recommend an LLC in these circumstances, it is usually not necessary. We frequently advise clients that forming an entity may not be necessary or is premature. Call us at 800-525-4780. We’re happy to help evaluate your unique circumstances.

How long does the entity formation process take?

Once you have determined the type of entity you would like to create and identified a name, our team will get started on the filing right away.While the incorporation process can vary from state to state, it generally takes about 10 days to two weeks, depending on the speed with which the respective Secretary of State processes the documents.

Can I get it faster than standard time?

Some states allow the process to be expedited for an additional fee.

You’ve set up my entity and provided my documents. What if I have a question?

Our services don’t end with the delivery of your corporate documents.Many clients have questions in the initial months of operation. We’re here to take your call and answer your questions so that you can be successful with your new entity.

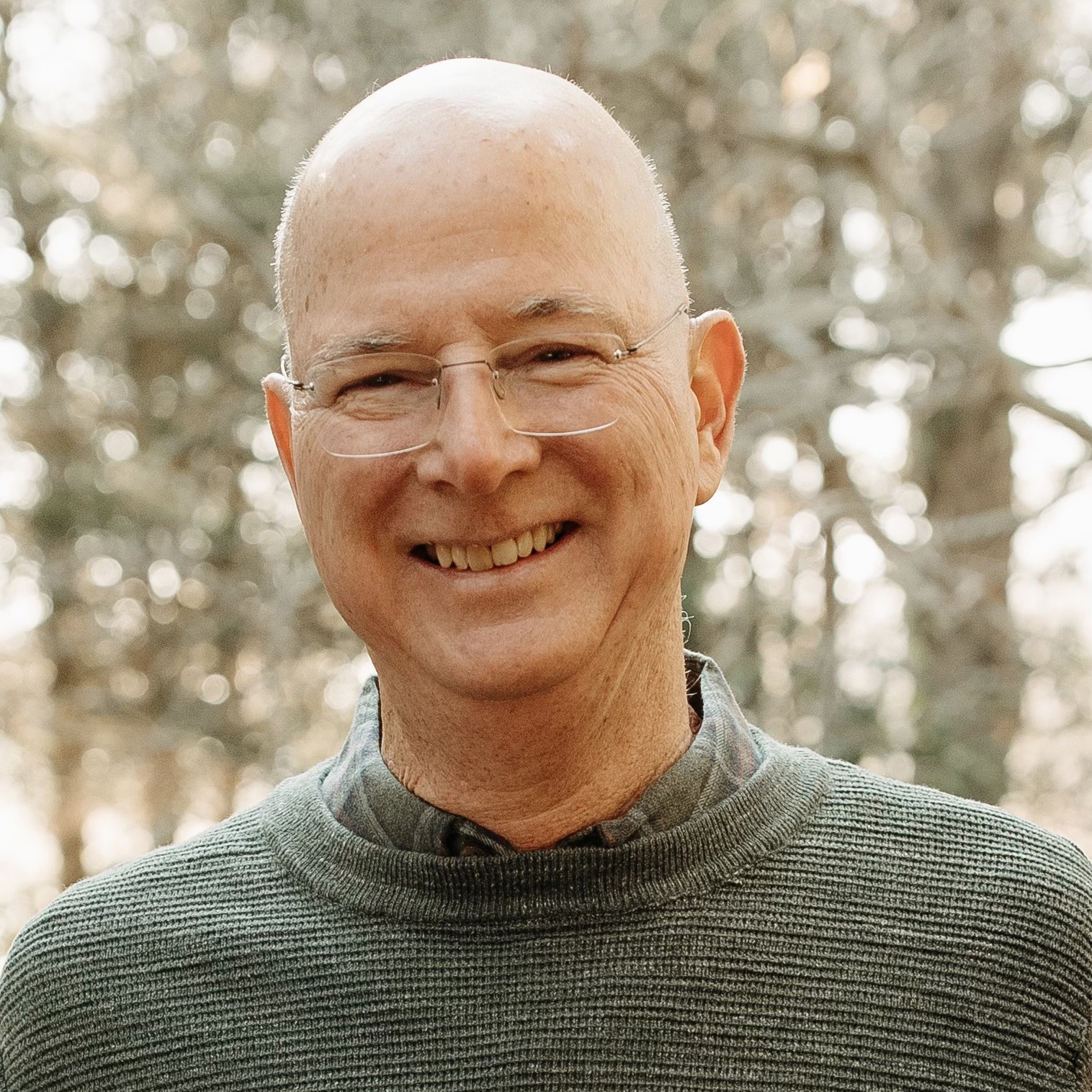

Meet Our Leader

Robert Stenson brings more than 30 years of experience practicing corporate, general business, and real estate law to his work helping clients navigate the entity formation process. Originally from Boston, he earned his undergraduate Bachelor of Science in Business Administration from Georgetown University. After working as an auditor for the global accounting firm, Arthur Andersen & Co., he moved west to pursue his law degree at UCLA. In addition to his experience in both law firms and in-house counsel positions, Robert has started multiple small businesses of his own — all of which inform his personalized and comprehensive approach to helping entrepreneurs get off to the right start.